As March begins, the Directorate General of Taxes (Ditjen Tax), the authority responsible for tax administration, typically intensifies its efforts to remind individual taxpayers to fulfill their obligation of submitting their Annual Tax Returns (SPT).

According to Article 3, paragraph (3) of the Law on General Provisions and Tax Procedures (UU KUP), individual taxpayers must submit their Annual Tax Returns within three months after the end of the fiscal year. Since the fiscal year for individual taxpayers typically runs from January to December, the deadline for submitting the Annual Tax Return is March 31.

Taxpayers, particularly those who believe they have complied with their tax payments, often wonder why they are still required to submit an Annual Tax Return (SPT). This article will explore the reasons behind this obligation.

Tax Collection System

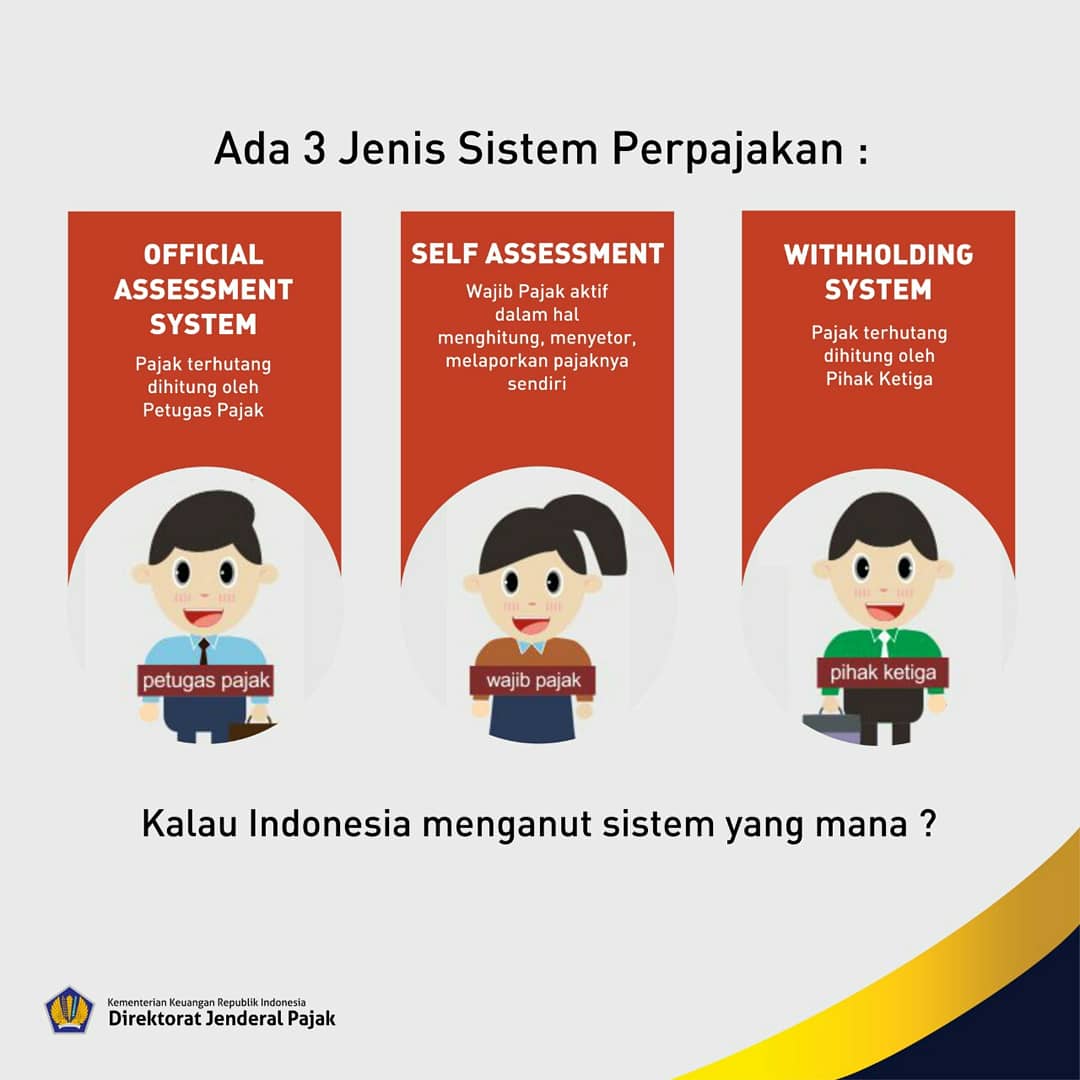

The mechanisms for implementing taxpayers’ rights and obligations need to be regulated within the taxation system. The taxation system, also known as the tax collection system, outlines how tax liability are managed and transferred to the State Treasury. Tax collection methods typically include the Self Assessment System (SAS), the Official Assessment System, and the Withholding Tax System (WHT).

In simple terms, the amount of tax owed in the Official Assessment System is determined entirely by the tax collecting authority. However, many believe that tax assessments in this system are made unilaterally. When this system is in place, decisions can result in tax burdens that far exceed the taxpayer’s expectations.

In contrast, under the Self Assessment System, the taxpayer calculates the amount of tax owed. The taxpayer is responsible for calculating, depositing, and reporting the tax. The role of the tax collecting authority is to conduct supervision and law enforcement activities, such as tax inspections and investigations. Many countries around the world have adopted the Self Assessment System because it is considered simpler, especially given the limited number of tax officers (fiscus) available.

Since the tax law reforms in 1983, which replaced the regulations established by the Dutch colonial government (the 1925 PPs ordinance and the 1944 PPd ordinance), Indonesia has transitioned from an Official Assessment System to a Self Assessment System. Under this system, taxpayers are entrusted with calculating, paying, and reporting the amount of tax owed based on the applicable tax laws and regulations.

With the Self Assessment System, tax administration tasks have changed from the past when authorities had to complete and determine all Tax Returns (SPT) to establish the amount of tax owed and to be paid. The Self Assessment System is considered ideal because taxpayers are best positioned to know their own tax obligations. The calculation and settlement of taxes are thus entrusted to each taxpayer.

In addition to transitioning to a self-assessment system, Indonesia also implemented a withholding tax system. Withholding Tax (WHT) is a tax collection method that empowers a third party (distinct from both the tax authorities and the taxpayer) to calculate the amount of tax owed. This system facilitates easier compliance with tax obligations, as third parties are responsible for tax calculations and directly deducting the owed amount, a task initially carried out by the taxpayer.

Tax return function

When taxpayers fulfill their tax obligations correctly and completely in accordance with the applicable provisions, their tax responsibilities are logically fulfilled. However, in reality, not all taxpayers are able to meet their obligations accurately.

Therefore, the Directorate General of Taxes continues its supervisory function to ensure the compliance of taxpayers who are entrusted with determining their own tax liabilities. This function involves research activities, inspections, and investigations into any criminal acts related to taxation.

Granting maximum authority and trust to taxpayers to calculate, pay, and report their own taxes is aimed at increasing legal compliance and their involvement in development activities. However, as a consequence, taxpayers must be knowledgeable about tax calculation procedures and all aspects related to tax payment.

Taxpayers bear the responsibility for understanding and fulfilling their tax obligations, including knowing when taxes are due, to whom they should be paid, and the potential sanctions for errors, omissions, or violations of tax laws.

Under the self-assessment system, at the end of the tax year, taxpayers must review their tax liabilities, comparing the amount owed with what has already been paid or deducted by third parties. This process may reveal either an underpayment or an overpayment of taxes.

In this system, it is ideal for taxpayers to promptly settle any tax shortfalls, while any overpaid taxes should be promptly refunded by the tax authority. Given that taxpayers shoulder the burden of compliance under the self-assessment system, it is reasonable to expect that the refund process be swift, accurate, cost-effective, and straightforward.

Moreover, tax administrations must prioritize fulfilling other rights of taxpayers, such as ensuring they receive excellent tax services. This is essential for fostering sustainable tax compliance.