After the Constitutional Court officially declared the Prabowo-Gibran presidential and vice presidential pair the winner in the 2024 election contest, the public began to look forward to some of their breakthroughs over the next five years. Through a vision-mission document called Asta Cita, Prabowo-Gibran has explained in detail what they will do for the next five years.

One of the visions that has generated the most public discussion is the establishment of an autonomous state revenue agency, Badan Otoritaria Penerimaan Negara (BOPN), which will be separate from the Ministry of Finance.

Background of Establish BOPN

The Prabowo-Gibran pair proposed the existence of BOPN, not without reason. In the Asta Cita document, the pair aims to strengthen political, legal, and bureaucratic reforms and the prevention and eradication of corruption and drugs. To achieve one of these goals, Prabowo-Gibran started by reforming governance. One form of reform that the two are pursuing is to establish a new State Revenue Agency.

The establishment of BOPN is not without basis, Prabowo-Gibran assumed that establishing BOPN would correlate to increased state revenue from within the country. Both assume that the establishment of BOPN will be able to increase the ratio of state revenue to gross domestic product (GDP) in accordance with their target, which is to reach 23%.

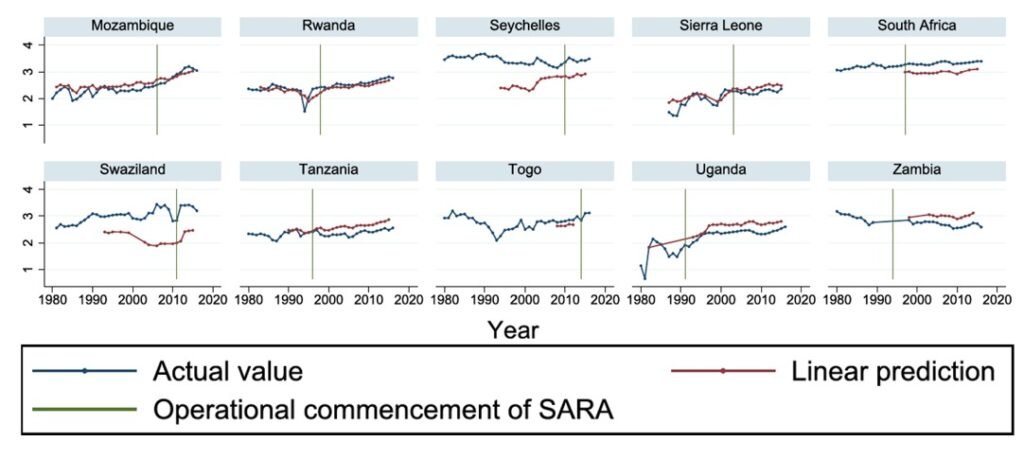

In various institutional literature, BOPN is often referred to as a Semi-Autonomous Revenue Authority (SARA). There are many countries that have developed SARAs and have identified the effectiveness of their establishment on the tax ratio. One US-based economic research institute, Jappesen, noted that the establishment of SARA has a positive effect on increasing the tax ratio in several sub-Saharan African countries in accordance with the targets set by their respective governments. Take a look at the table below

Source: Jeppesen

Source: Jeppesen

Starting from the figure above, the assumption that the establishment of BOPN by adopting the SARA system can increase a country’s tax ratio seems to be true. Several countries in sub-Saharan Africa have shown an increase in tax ratio after the establishment of SARA.

In Indonesia, the establishment of BOPN has actually been initiated since 2014 when the institutional study of the Directorate General of Taxes (DGT) was released by AIPEG or Australia Indonesia Partnership for Economic Governance (Ministry of Finance, 2016). The AIPEG study used the institutional economic theory framework with the result that DGT has governance problems and its authority in the areas of organization, budget, and finance is limited.

As recommended by AIPEG, DGT needs to create a roadmap to transform its institution into a semi-autonomous body separated from the Ministry of Finance. AIPEG’s proposal was incorporated into the 2016 Draft Law on General Provisions and Tax Procedures (RUU KUP).

The bill targets BPN to start operating effectively on January 1, 2017, and replace DGT’s duties, functions, and authorities. However, according to the lawmakers at the time, the most rational policy option was for the DGT to remain under the Ministry of Finance until now.

After being delayed until today, the discourse was revived by the 2024-2029 Presidential and Vice Presidential Couple Prabowo-Gibran. When the new government carries out one of its missions by establishing a BPN, what is the policy, regulatory, and institutional design of the BPN?

Can BOPN Guarantee an Increase in Tax Ratio?

As quoted from detikFinance, taxation observer and Executive Director of the Pratama Institute for Fiscal Policy and Governance Studies, Prianto Budi Saptono, said that besides taking a long time, there is no guarantee that the move to form BPN (or BOPN) will succeed in increasing the tax ratio, (detikFinance Thursday, March 21, 2024).

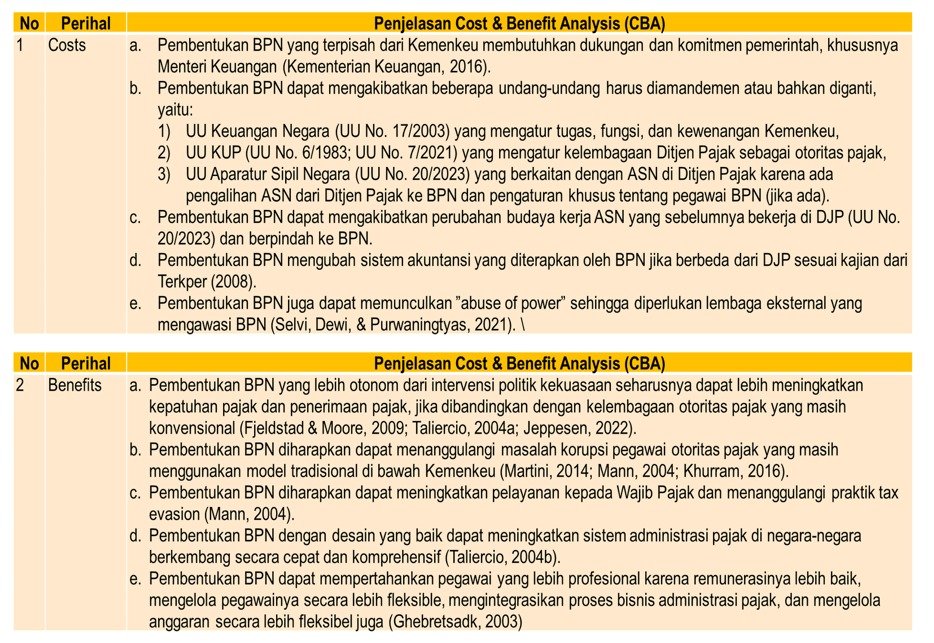

He added, “The establishment of a BPN that is separate from the Ministry of Finance requires government support and commitment, especially the Minister of Finance. The establishment of BPN may result in several laws having to be amended or even replaced” (detikFinance Thursday, March 21, 2024).

In another statement, Prianto added that BPN needs supervision from external institutions to minimize the potential for power abuse.

“The establishment of BPN can also lead to ‘abuse of power’ so that an external institution is needed to supervise BPN” (detikFinance Thursday, March 21, 2024).

In order to answer the above questions, it is necessary to conduct a Cost and Benefit analysis which has been compiled in the table below.

Source: presentation material Badan Penerimaan Negara (BPN): Kebijakan, Regulasi, dan Kelembagaan Komwasjak, Prianto Budi Saptono

From the table above, it can be concluded that the establishment of BOPN will cause some homework, as well as some risks that will accompany it. In addition to several laws that must be amended, the potential for abuse of power is also an issue that will accompany the establishment of BOPN.

However, BOPN is also worth considering considering the benefits that will come from its establishment. Among the benefits that can be used as the basis of why BOPN needs to be formed are the potential for increased tax compliance, which will increase tax revenue, minimize the potential for fraud, and the formation of an autonomous BOPN will be able to minimize excessive intervention of political interests.

Concerns about Abuse of Power

Without strict supervision, the establishment of a new institution with BOPN authority could potentially cause abuse of power issues and become a new field of corruption.

In the book Internal Revenue Service (IRS) Historical Study: IRS Historical Fact Book: A Chronology 1646-1992, it was noted that in 1952, it was found that the majority of IRS employees stumbled upon cases of corruption, tax evasion, and bribery, which resulted in huge losses for the US. As a result, Henry S Truman (the US president at the time) carried out a major reorganization and overhaul of the tax collection system by the IRS, such as decentralizing many tax collection functions to district offices that replaced the function of collection offices. However, the problem can be minimized by the establishment of an independent oversight institution.

Indonesia’s low tax ratio is not a figment of the imagination. According to the OECD report Revenue Statistics in Asia and Pacific 2022 (July 25, 2022), Indonesia’s tax ratio was in the bottom third of 28 Asia Pacific countries in 2022. Indonesia’s tax ratio in 2023 will only reach 10.21%. As a country with a large gross domestic tax potential, the low tax ratio is certainly a colossal and prolonged homework.

Various measures have been taken, from adjusting policies to reforming tax laws, but they have not had a significant impact on the tax ratio. In the midst of the deadlock in efforts to increase the tax ratio, the issue of establishing a State Revenue Agency (BOPN) separate from the Ministry of Finance has surfaced again and is considered a worthy effort.

The complexity of the problem requires the new government to find the right formulation for increasing state revenue. Moreover, the fiscal fate of a country is highly dependent on the efficiency and effectiveness of state revenue collection and management, as well as on how obedient citizens are in paying taxes.

Although there is no guarantee that the presence of BOPN can increase Indonesia’s tax ratio in the near future, the establishment of BOPN deserves to be an alternative solution that can be expected to boost the tax ratio, increase tax awareness, and increase tax revenue.